Level Up Identity Authentication Procedures With Face Check ID

A significant surge in identity spoof and impersonation attacks has been observed over the recent few decades. Cybercriminals use unauthorized channels through which they steal the customer’s confidential details and exploit them for the illegal acquisition of legitimate services. They use the stolen information to conceal their identities in case of criminal screening operations.

Therefore, industries must expand their authentication operations by utilizing facial recognition checks during the onboarding. The global face check ID authentication market is expected to acquire a share of $13.4 billion by 2028. These checks play a critical role in eliminating financial scams, including illicit monetary transactions and spoofing attacks.

What is the Significance of Face ID Verification?

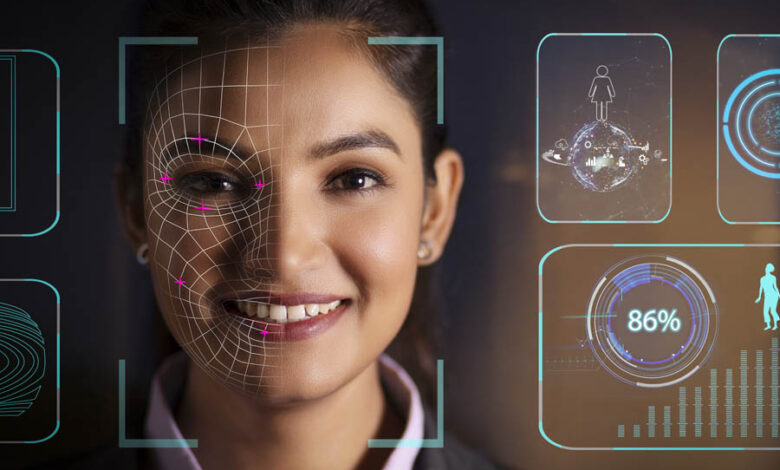

Face check ID, commonly known as facial recognition, is the practice of analyzing the customer’s identity profiles through digital identification channels. These checks are some of the most frequently used biometric authentication procedures and are widely used for the detection of unauthorized entities. Face ID checks undertake the identity validation procedures through the incorporation of facial liveness detection procedures, which streamline the evaluation of customer’s biometric characteristics.

Facial recognition solutions are operated with the considerations of deep-learning modules. This boosts the system’s 3D depth analysis process, which allows the examiners to identify possible impersonation and spoofing attacks. Moreover, face-check ID procedures ensure microexpression analysis. This process emphasizes the examination of the customer’s live expressions, including eye blink, head movement, and smiling. The customer’s facial characteristics are precisely evaluated through enhanced face mapping techniques, which leaves no room for imposter’s illicit activities.

How Does Photo Identity Verification Work?

Photo identity authentication is a dynamic process through which identity examiners identify the legitimacy of unknown customers. This process is examined below:

- Face check ID operations begin with the customer’s facial detection through enhanced computer vision frameworks. In this step, the examiners analyze the customer’s front and side profiles.

- Identity examiners utilize 3D depth and expression analysis tools to comprehend whether the person in front of the camera contains three-dimensional data or not.

- In the next step, the facial identification modules map the customer’s facial characteristics through geometric facial expression analysis. This examines the distance between the customer’s eyes and ears. Furthermore, the depth and shape of their facial characteristics are evaluated in this process as well.

- Finally, the customer’s live facial behaviors are cross-referenced with their identity documents that are stored in the government’s official databases and directories.

How are Photo ID Check Used in Different Instances?

- Face check IDs are extensively used to stimulate the protection of customer’s mobile phones. These checks eliminate the data breach attempts that were very common in the past, providing an additional security layer against cyber criminals.

- Moreover, facial identity authentication checks play a critical role in the identification of several fraudulent activities. Facial verification checks must be conducted every time a person conducts monetary transactional activities. This prevents imposters from exploiting the legitimate customer’s financial bank account status, ensuring cybersecurity among different channels.

- Face check ID can also be utilized to stimulate border control activities in airports. These checks stimulate the traveler’s onboarding process as they limit the access of illicit entities to the airline services.

- Furthermore, healthcare institutions can enhance the protection of patients’ medical records from cyber criminals’ illicit behaviors. These checks limit the access of medical services to legitimate patients only.

How Does Face Check Protect Businesses from Various Cyber Attacks?

Facial identity recognition procedures protect businesses from several cyberattacks, including deep fakes, money laundering, and impersonation attacks. These checks are equipped with the latest depth and pattern analysis techniques, which effectively detect the presence of deep fakes and impersonators.

During facial liveness detection operations, the customers are requested to perform certain tasks and answer some identity-relevant questions. Only legitimate entities are able to perform these tasks and answer related questions because deep fake entities and impersonators are unable to tackle such operations.

Why Should Businesses Invest in Photo ID Verification?

Face-check IDs facilitate a secure and precise customer onboarding process. These checks provide real-time authentication instantly, which enhances the customer’s onboarding experience. The enhanced face mapping and texture analysis operations combat the negative influence of impersonators. Moreover, facial identity authentication is capable of supporting customers remotely from different parts of the world. The customers can choose specific authentication examiners who speak a language similar to theirs. This allows the customers and examiners to efficiently interact with each other without any language barriers.

Final Thoughts

Face check ID plays a critical role in the online identification of remote customers. These checks rely on the functionality of the machine-learning modules, which allows them to detect and identify the presence of unauthorized entities. Facial identity recognition algorithms ensure that the customer’s facial characteristics are examined extensively, which prevents the negative influence of cyber criminals in real-time. Furthermore, facial identity authentication checks are applicable in various scenarios, which shows their adaptability and accuracy in identity validation procedures.